The market landscape of beachfront real estate along the 30A shores has undergone a significant shift in the wake of rising interest rates, fundamentally altering who holds the keys to the sandcastle kingdom.

The Cash Buyer Wave

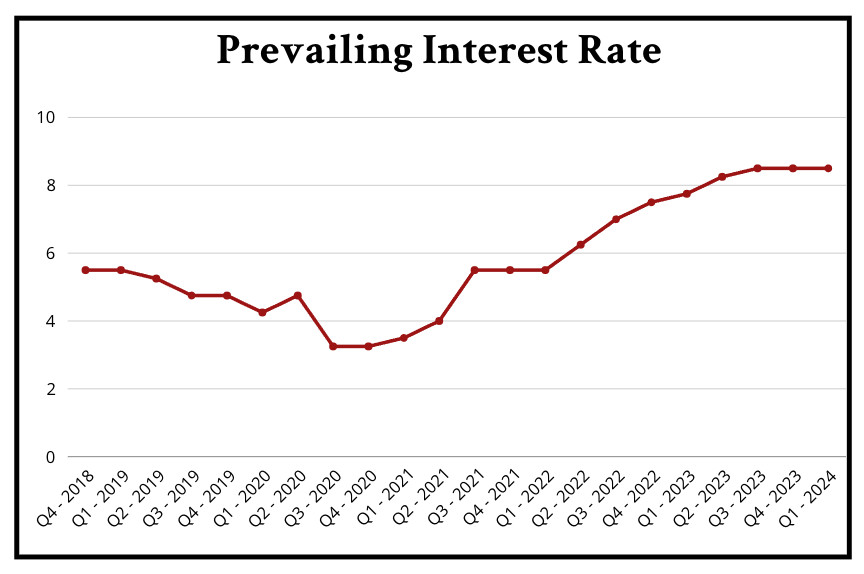

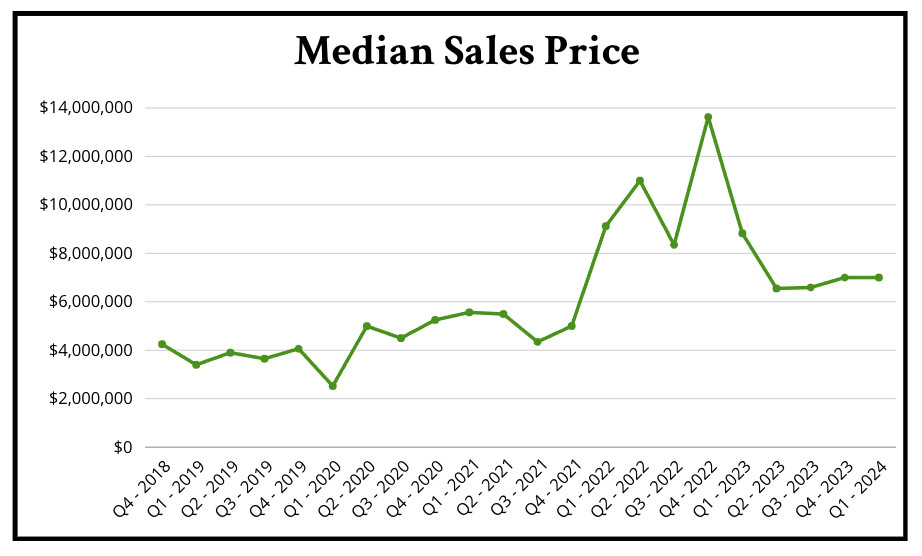

Since the second quarter of 2022, when the interest rates climbed past the 6% threshold, the waves have carried in a higher proportion of cash buyers. This influx has not been a mere trickle; the rise from 5.50% to 6.25% in interest rates caused a tidal shift in the market’s dynamics. As rates soared, so did the median purchase price. The increase in Median values simply means that more expensive properties sell.

This change has had profound consequences for prospective homeowners.

First, we have less leveraged investors relying on rental income. For them, cashflow is king: if interest rates rise, then mortgage payments go up. They have only two solutions to mitigate this problem: (1) buy something cheaper or (2) don’t buy at all. This void in transactions of lower-priced rental houses has naturally moved the Median prices up.

Second, we have more cash buyers that are also end-users. For them, cashflow is not important, but comfort is. They tend to buy more luxurious properties. Furthermore, any reduction in the number of rental units on 30A is perceived by these owners as a positive factor. Less tourists mean more privacy, more security, and more exclusivity. These factors lead to strong real estate values.

A Speculative Surge

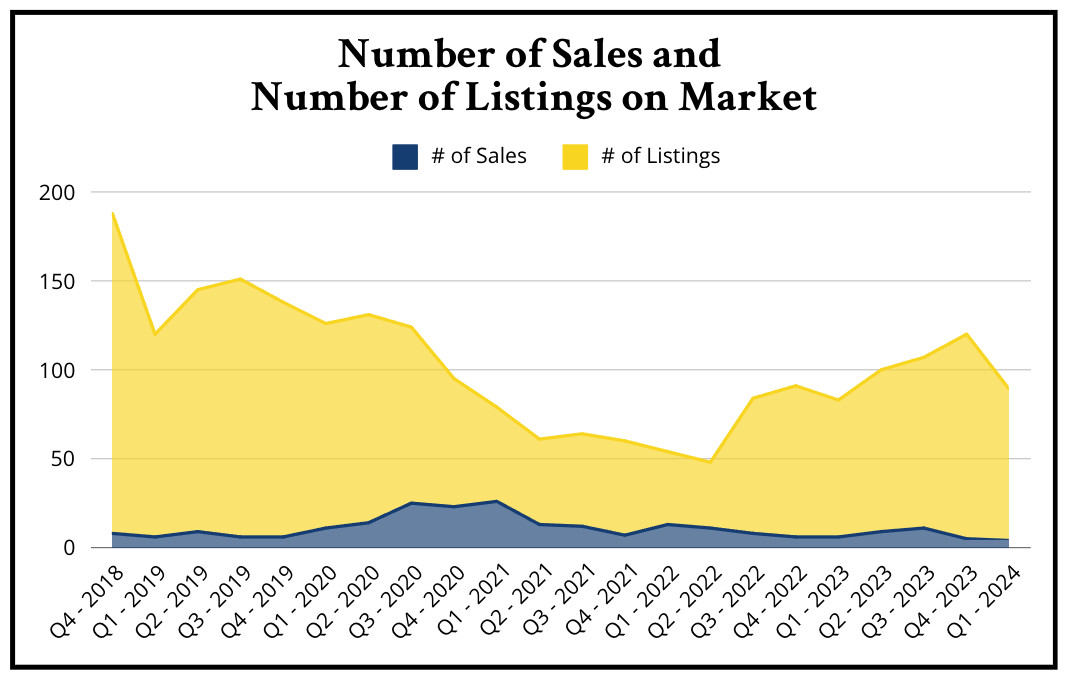

The number of active listings on the homes adorning the sun-kissed stretches of 30A has danced to the tune of these shifting interest rates. But not how you might expect. It is not the rates themselves, but the speculation they foster that has sent ripples through the market. As homeowners foresee rising prices, they retreat, holding their listings back like prized pearls in the depths of their investment portfolios.

This speculation has roots in recent history. The COVID pandemic’s onset saw a swell in listings, with over 40 beachfront houses up for grabs in January 2020. However, this number soon began to ebb, dwindling month by month, as if the properties themselves were being pulled back into the sea. By the time we reached the later months of 2020 and into early 2021, the number of listings had plummeted, mirroring the interest rates that had sunk to inviting lows.

Interest Rates and Inclusivity

Yet, it’s not all high water and withdrawal. The period between the first quarter of 2020 and the second quarter of 2022 offered a glimpse into a more inclusive market. Interest rates, markedly below 6%, served as a siren call to a broad church of buyers. Both cash buyers and those in need of a mortgage flocked to 30A, drawn by the affordable borrowing costs, resulting in a surge of transactions.

The sea of beachfront real estate is, it seems, particularly sensitive to the climate of interest rates. With rates low, the waters are warm and welcoming to all. But as they climb, the chill sets in, and only those with the means to pay the piper—or rather, the full price in cash—can play in these exclusive waters.

Conclusion

As we look to the horizon, the message in a bottle for potential buyers and sellers seems clear: interest rates and market speculation shape the shores of 30A’s beachfront real estate. And as the market adjusts to these currents, only those with the foresight to navigate these waters will find a safe harbor in the ever-changing world of property and prosperity.

What Should We Make of the Next Twelve Months?

Interest rates are likely to remain slightly over the 6% mark until the end of this year – an election year. Election years are traditionally slow and haphazard. More encouraging is the increase in the number of houses for sale coupled with a further influx of wealthy buyers willing to relocate in our sunny shores. We therefore anticipate a gradual growth in the number of high-end transactions during the second and third quarters of 2024.